The resources you need to make SOLAR EASY are right here!

Our goal is to help you understand and navigate the process of going solar. Through these resources, learn about current opportunities, policies and the pathways to installing residential solar, from working through a bid from an installer to tax benefits and financing. Contact us with questions!

In 2024 we are noticing an influx in businesses that offer residential solar installations. We encourage you to get more than one bid. Ask a company how long they've been working in Montana. The folks we've worked with would never pressure you to jump immediately; as much as this is a great time to go solar, you do have time to compare bids and figure out what is best for you and your home.

The 2022 Inflation Reduction Act returned the tax credits for residential solar to 30% through 2032. Check out this amazingly helpful: Homeowners Guide - Federal Tax Credit for Solar (2023).

And we'd love to hear about your experience - good, bad, or otherwise. Send us a solar note: [email protected]

Read on below for an overview of solar financing options and available incentives.

Our goal is to help you understand and navigate the process of going solar. Through these resources, learn about current opportunities, policies and the pathways to installing residential solar, from working through a bid from an installer to tax benefits and financing. Contact us with questions!

In 2024 we are noticing an influx in businesses that offer residential solar installations. We encourage you to get more than one bid. Ask a company how long they've been working in Montana. The folks we've worked with would never pressure you to jump immediately; as much as this is a great time to go solar, you do have time to compare bids and figure out what is best for you and your home.

The 2022 Inflation Reduction Act returned the tax credits for residential solar to 30% through 2032. Check out this amazingly helpful: Homeowners Guide - Federal Tax Credit for Solar (2023).

And we'd love to hear about your experience - good, bad, or otherwise. Send us a solar note: [email protected]

Read on below for an overview of solar financing options and available incentives.

|

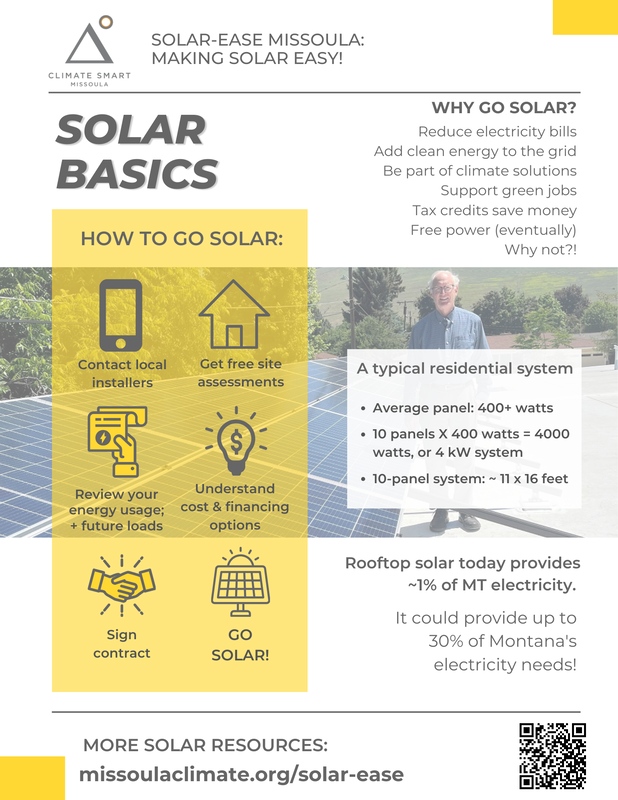

View our Solar Basics 2-Pager (PDF - right click and save below)

|

Vertical Divider

|

Our Solar-Ease partners include:

Partner Resources

|

Solar Financing Basics

Considering installing solar on your home, business or nonprofit? There are several financing options: cash payment, loans, or solar leasing.

Cash payment is pretty self-explanatory, though the decision about whether it's better to use cash or take out a low-interest loan (or a combination thereof) is a personal one and depends on what the cash would be used for otherwise. (We recommend consulting your financial institution or adviser; also see Clearwater Credit Union's helpful Financial Analysis of Residential Solar - Guide for Homeowners.)

Low-interest loans are also available; see below for more information. Whether you pay up front with cash or take out a loan, you are eligible for a 30% Federal tax credit, effectively reducing the cost of your solar project by 30%! (Note that, at this time, the 30% residential credit only applies to owner-occupied homes, not rentals.)

Solar leasing is a financing option that has been around for a while in other parts of the country but is relatively new in Montana with the growth of the solar industry and as out-of-state companies expand into Montana. Before entering into a lease agreement for solar, it's essential to do your due diligence and research. There are pros and cons to leasing, and it's important to fully understand the terms of the lease and how you might be impacted if you sell your home, want to purchase your panels, or the leasing company goes out of business.

Here are a few helpful resources about solar leasing, and as always, we recommend getting multiple bids from installers before moving forward on any home solar or electrification project!

Cash payment is pretty self-explanatory, though the decision about whether it's better to use cash or take out a low-interest loan (or a combination thereof) is a personal one and depends on what the cash would be used for otherwise. (We recommend consulting your financial institution or adviser; also see Clearwater Credit Union's helpful Financial Analysis of Residential Solar - Guide for Homeowners.)

Low-interest loans are also available; see below for more information. Whether you pay up front with cash or take out a loan, you are eligible for a 30% Federal tax credit, effectively reducing the cost of your solar project by 30%! (Note that, at this time, the 30% residential credit only applies to owner-occupied homes, not rentals.)

Solar leasing is a financing option that has been around for a while in other parts of the country but is relatively new in Montana with the growth of the solar industry and as out-of-state companies expand into Montana. Before entering into a lease agreement for solar, it's essential to do your due diligence and research. There are pros and cons to leasing, and it's important to fully understand the terms of the lease and how you might be impacted if you sell your home, want to purchase your panels, or the leasing company goes out of business.

Here are a few helpful resources about solar leasing, and as always, we recommend getting multiple bids from installers before moving forward on any home solar or electrification project!

Tax Credits - We have new federal rates and more eligible entities thanks to the Inflation Reduction Act. These are effective now, and valid through 2034!

Federal: As of today, federal tax credits for residential and commercial solar energy systems are available at 30% through 2032. The credit has returned to this rate with the passage of the climate legislation. You read that right = 12 years! In addition, tax-exempt entities like nonprofits, local government buildings, and churches that were previously ineligible for the credit can now also benefit from this 30% credit through a new "direct pay" provision in the Inflation Reduction Act. This is GREAT news!

See this Department of Energy updated resource for more details: Homeowners Guide - Federal Tax Credit for Solar (2023)

State: Unfortunately, the residential solar tax credit expired at the end of 2021.

Federal: As of today, federal tax credits for residential and commercial solar energy systems are available at 30% through 2032. The credit has returned to this rate with the passage of the climate legislation. You read that right = 12 years! In addition, tax-exempt entities like nonprofits, local government buildings, and churches that were previously ineligible for the credit can now also benefit from this 30% credit through a new "direct pay" provision in the Inflation Reduction Act. This is GREAT news!

- 30% tax credit for all systems placed in service (this effectively reduces the cost of your new system by 30%).

- There is no maximum credit..

- The home served by the system does not have to be the taxpayer’s principal residence.

See this Department of Energy updated resource for more details: Homeowners Guide - Federal Tax Credit for Solar (2023)

State: Unfortunately, the residential solar tax credit expired at the end of 2021.

Loan Options

Montana Department of Environmental Quality (DEQ) offers an Alternative Energy Revolving Loan Program funded by air quality penalties collected by the DEQ. Energy conservation measures installed in conjunction with an alternative energy project can also be funded through the program. Interest rates for 2023 are fixed at 3.5% (4.023%APR).

Clearwater Credit Union offers Solar Loans. Call or visit their website for more information.

Commercial Property Assessed Capital Enhancement (C-PACE) - C-PACE is a relatively new (2022) program offered by the State of Montana for commercial buildings. Solar systems are eligible and details can be found at the LastBestPace.com. MTPACE can cover up to 100% of eligible project costs, and payments are repaid through a special property tax assessment with terms up to 20 years. As a result, projects become cash positive from day one. Projects greater than $75,000 may be eligible. If the aggregate project is less than $75,000, C-PACE may not be the best option. MT C-PACE is a fit for most industries including commercial office buildings and nonprofit organizations (including places of worship), and multi-tenant buildings.

Montana Department of Environmental Quality (DEQ) offers an Alternative Energy Revolving Loan Program funded by air quality penalties collected by the DEQ. Energy conservation measures installed in conjunction with an alternative energy project can also be funded through the program. Interest rates for 2023 are fixed at 3.5% (4.023%APR).

Clearwater Credit Union offers Solar Loans. Call or visit their website for more information.

Commercial Property Assessed Capital Enhancement (C-PACE) - C-PACE is a relatively new (2022) program offered by the State of Montana for commercial buildings. Solar systems are eligible and details can be found at the LastBestPace.com. MTPACE can cover up to 100% of eligible project costs, and payments are repaid through a special property tax assessment with terms up to 20 years. As a result, projects become cash positive from day one. Projects greater than $75,000 may be eligible. If the aggregate project is less than $75,000, C-PACE may not be the best option. MT C-PACE is a fit for most industries including commercial office buildings and nonprofit organizations (including places of worship), and multi-tenant buildings.

More solar tidbits and ideas...

Electrification: Do you still have gas appliances in your home? Consider electrifying hand in hand with going solar. Lots more resources and info at ElectrifyMissoula.org!

Energy Smart: Energy savings and renewables go hand in hand! Residential energy accounts for nearly a quarter of our community's carbon emissions. Visit our Energy Smart page to learn ways you can reduce energy use at home.

Energy Smart: Energy savings and renewables go hand in hand! Residential energy accounts for nearly a quarter of our community's carbon emissions. Visit our Energy Smart page to learn ways you can reduce energy use at home.

Creative Ways to Support Solar

Not everyone can get rooftop solar arrays but everyone can benefit from solar energy. Help us support better policy, encourage and educate your friends and neighbors, and share your solar stories with us!

Not everyone can get rooftop solar arrays but everyone can benefit from solar energy. Help us support better policy, encourage and educate your friends and neighbors, and share your solar stories with us!

- Take time to educate yourself about the process of going solar, (watch our great video below!) so you can be solar ready when the opportunity is right!

- Support community solar! Check out Missoula Electric Co-op to see what one community solar effort looks like. (Unfortunately, state law currently prohibits investor owned utilities from offering community solar programs - we need this to change so the benefits of solar are accessible to everyone!)

- Stay connected and lend your voice to help make policy change in the future.

More Solar-Ease Resources

|

Solar How-To Videos:

Interested in installing solar at your home or business but not sure how to get started? These short videos from MREA and Climate Smart explain everything you need to know. Spoiler alert: it's really easy! Video #2: Solar Financing Options & Considerations

*Please note some loan and tax credit options referenced in the video may have changed. More updated information is at the top of the page. |